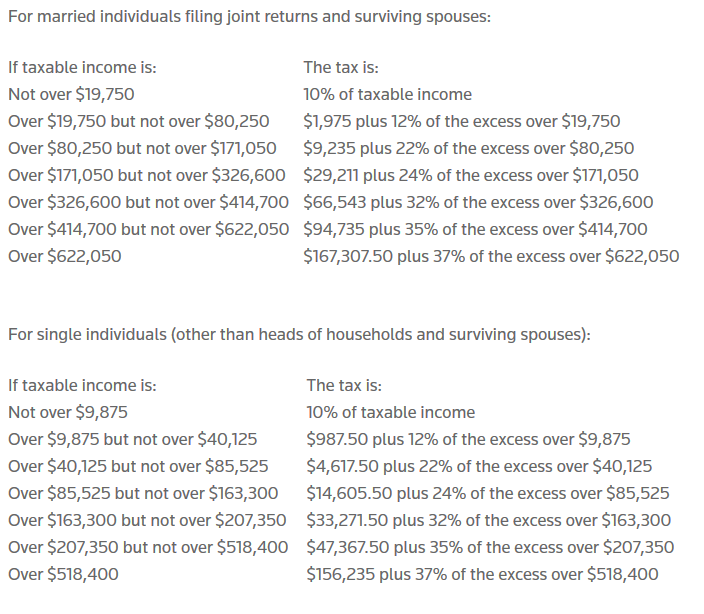

Tax Brackets 2020 Standard Deduction . 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). tax brackets and tax rates. see current federal tax brackets and rates based on your income and filing status. The standard deduction for single filers will increase by $200, and by $400 for married. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. There are seven (7) tax rates in 2020. standard deduction and personal exemption. tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by $200, and by $400 for married. You pay tax as a percentage of.

from www.cpapracticeadvisor.com

the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). see current federal tax brackets and rates based on your income and filing status. tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by $200, and by $400 for married. You pay tax as a percentage of. The standard deduction for single filers will increase by $200, and by $400 for married. standard deduction and personal exemption. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. There are seven (7) tax rates in 2020. tax brackets and tax rates.

Projected Tax Brackets for 2020, With Standard Deductions and

Tax Brackets 2020 Standard Deduction the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. standard deduction and personal exemption. The standard deduction for single filers will increase by $200, and by $400 for married. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by $200, and by $400 for married. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). There are seven (7) tax rates in 2020. tax brackets and tax rates.

From www.pinterest.com

Standard Deduction 2020 Tax Brackets 2020 Standard Deduction You pay tax as a percentage of. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. see current federal tax brackets and rates based on your income and filing status. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from. Tax Brackets 2020 Standard Deduction.

From pippayfelisha.pages.dev

Tax Brackets 2024 Standard Deduction Nonah Annabela Tax Brackets 2020 Standard Deduction 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). standard deduction and personal exemption. see current federal tax brackets and rates based on your income and filing status. There are seven (7) tax rates in 2020. tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will. Tax Brackets 2020 Standard Deduction.

From www.northscottpress.com

IDR 2020 interest rates, standard deductions and tax brackets Tax Brackets 2020 Standard Deduction tax brackets and tax rates. The standard deduction for single filers will increase by $200, and by $400 for married. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. There are seven (7) tax rates in 2020. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also. Tax Brackets 2020 Standard Deduction.

From garetcell.weebly.com

2020 federal tax brackets garetcell Tax Brackets 2020 Standard Deduction There are seven (7) tax rates in 2020. standard deduction and personal exemption. tax brackets and tax rates. The standard deduction for single filers will increase by $200, and by $400 for married. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. You pay tax as a. Tax Brackets 2020 Standard Deduction.

From homesbusinesss.blogspot.com

Standard Business Deduction 2022 Home Business 2022 Tax Brackets 2020 Standard Deduction standard deduction and personal exemption. You pay tax as a percentage of. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). The standard deduction for single filers will increase by $200, and by. Tax Brackets 2020 Standard Deduction.

From goneonfire.com

2019 & 2020 Federal Tax Brackets Side by Side Comparison Gone Tax Brackets 2020 Standard Deduction the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. There are seven (7) tax rates in 2020. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. You pay tax as a percentage of. standard deduction and. Tax Brackets 2020 Standard Deduction.

From goneonfire.com

2020 & 2021 Federal Tax Brackets A Side by Side Comparison Tax Brackets 2020 Standard Deduction You pay tax as a percentage of. There are seven (7) tax rates in 2020. The standard deduction for single filers will increase by $200, and by $400 for married. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). the table below shows the levels in 2020 for all income tax brackets, the personal. Tax Brackets 2020 Standard Deduction.

From www.cpapracticeadvisor.com

Projected Tax Brackets for 2020, With Standard Deductions and Tax Brackets 2020 Standard Deduction The standard deduction for single filers will increase by $200, and by $400 for married. see current federal tax brackets and rates based on your income and filing status. standard deduction and personal exemption. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. 10%, 12%, 22%,. Tax Brackets 2020 Standard Deduction.

From www.newsnatic.com

Federal Tax Brackets 2020 & Tax rates 2020 Tax Brackets 2020 Standard Deduction tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by $200, and by $400 for married. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. There are seven (7) tax rates in 2020. the table below shows the. Tax Brackets 2020 Standard Deduction.

From www.groupon.com

20202021 Tax Brackets Updated Tax Brackets 2020 Standard Deduction The standard deduction for single filers will increase by $200, and by $400 for married. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. You pay tax as a percentage of. the table below shows the levels in 2020 for all income tax brackets, the personal exemption,. Tax Brackets 2020 Standard Deduction.

From productwest.weebly.com

Tax brackets 2020 federal productwest Tax Brackets 2020 Standard Deduction tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by $200, and by $400 for married. The standard deduction for single filers will increase by $200, and by $400 for married. standard deduction and personal exemption. the standard deduction for married filing jointly rises to $24,800 for tax year. Tax Brackets 2020 Standard Deduction.

From evangelinwkata.pages.dev

Tax Brackets 2020 Irs Molly Therese Tax Brackets 2020 Standard Deduction tax brackets and tax rates. You pay tax as a percentage of. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. see current federal tax brackets and rates based on your income and filing status. the standard deduction for married filing jointly rises to $24,800 for. Tax Brackets 2020 Standard Deduction.

From standard-deduction.com

1040 Standard Deduction 2020 Standard Deduction 2021 Tax Brackets 2020 Standard Deduction tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by $200, and by $400 for married. You pay tax as a percentage of. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. 10%, 12%, 22%, 24%, 32%, 35% and. Tax Brackets 2020 Standard Deduction.

From kotisupplier.weebly.com

Irs tax brackets 2020 vs 2021 kotisupplier Tax Brackets 2020 Standard Deduction the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. see current federal tax brackets and rates based on your income and filing status. standard deduction and personal exemption. tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by. Tax Brackets 2020 Standard Deduction.

From projectopenletter.com

2022 Federal Tax Brackets And Standard Deduction Printable Form Tax Brackets 2020 Standard Deduction the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. standard deduction and personal exemption. see current federal tax brackets and rates based on your income and filing status. tax brackets and tax rates. You pay tax as a percentage of. the standard deduction for married. Tax Brackets 2020 Standard Deduction.

From blog.churchillmortgage.com

What to Expect When Filing Your Taxes This Year Tax Brackets 2020 Standard Deduction the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. tax brackets and tax rates. standard deduction and personal exemption. The standard deduction for single filers will increase by $200, and by $400 for married. see current federal tax brackets and rates based on your income and. Tax Brackets 2020 Standard Deduction.

From bikerbookkeeper.com

2020 Tax Brackets M Hernandez Taxes Bookkeeping Tax Brackets 2020 Standard Deduction tax brackets and tax rates. You pay tax as a percentage of. standard deduction and personal exemption. tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by $200, and by $400 for married. There are seven (7) tax rates in 2020. The standard deduction for single filers will increase. Tax Brackets 2020 Standard Deduction.

From tanknibht.weebly.com

2020 to 2021 tax brackets tanknibht Tax Brackets 2020 Standard Deduction 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). tax foundation | 2 standard deduction and personal exemption the standard deduction for single filers will increase by $200, and by $400 for married. the standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year.. Tax Brackets 2020 Standard Deduction.